XRP Faces Slump as concerns over the US election and the SEC appeal weigh heavily on its market performance. This piece analyzes the factors contributing to the decline and what it could mean for investors navigating this volatile landscape.

Key Points:

- XRP falls below $0.52 amid a widespread crypto market sell-off, fueled by US election concerns and increasing Treasury rates.

- Elon Musk’s views on the XRP Ledger sparked controversy, driving interest while Ripple battled the SEC in appellate courts.

- Investors are bracing for XRP volatility as the SEC’s opening brief and the US election influence cryptocurrency markets.

In this article:

- TSLA+2.84%

- XRP-1.12%

XRP Drops Below $0.52 Amid Broader Crypto Sell-Off

On Wednesday, October 23, XRP fell 1.39% to $0.5255, following a 2.24% drop the previous day.

XRP followed the larger crypto market, which slid 1.45% on Wednesday to a market capitalization of $2.242 trillion.

Experts trade the markets with IC Markets

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spread

Fears over the US presidential election pushed 10-year US Treasury rates up, reducing demand for riskier assets such as cryptocurrency. Falling expectations on a December Fed rate decrease led to the crypto market’s drop.

Elon Musk and the XRP Ledger

On Wednesday, the crypto community continued to examine Elon Musk’s recent statements on the XRP Ledger. In response to a query on the potential use of XRPL by financial institutions, Tesla (TSLA) CEO remarked,

“This is definitely not an endorsement or lack of endorsement for XRP, but I do think crypto, by its very nature, helps with individual freedom.”

Ripple prepares for a len.idates who ignore crypto and blockchain tech could experience a sharp loss of voter support.

According to the most recent electoral polls, Donald Trump has a good chance of winning the US presidential election. While investors may view Trump’s attitude on cryptocurrency optimistic, his wider plans might promote inflation, potentially influencing the Fed’s rate path as XRP Faces Slump

SEC vs. Ripple: Opening Brief Crucial for XRP

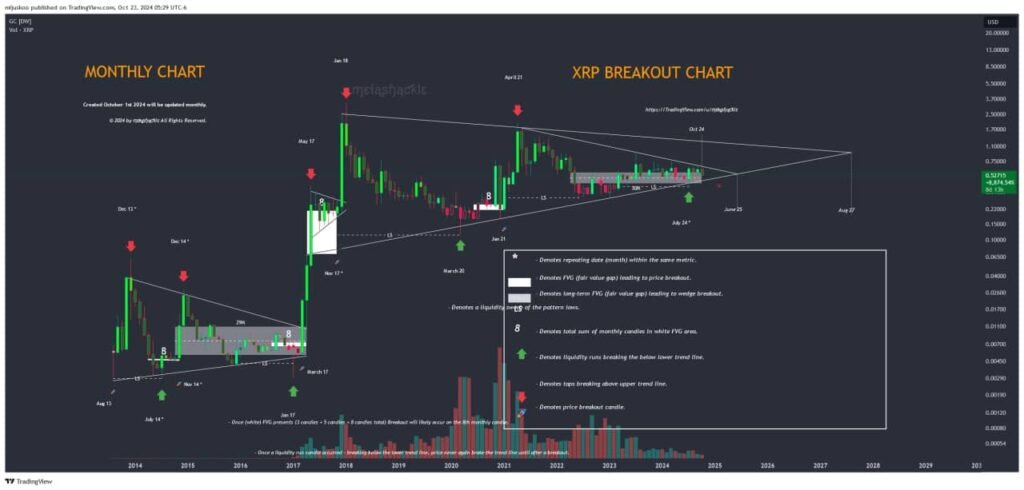

On Wednesday, the XRP dropped below $0.52, signaling a severe increase in volatility. XRP recently dipped below $0.52 on October 3rd, after the SEC’s Notice of Appeal.

Investors are carefully following developments in the SEC’s appeal against Ripple, particularly as the agency prepares to file its opening brief.

The opening brief outlines the SEC’s legal arguments in contesting judgments, including the Programmatic Sales of XRP ruling, which may impact XRP price movements. Furthermore, the opening brief delivers arguments against judgments without response, making a first impression on the court.

The SEC’s opening brief and arguments against the Programmatic Sales order may help pro-crypto attorneys determine the possibility of a successful appeal. XRP volatility grew significantly in reaction to the submissions that resulted in the July 2023 Summary Judgment and the August 2024 Final Judgment.

Following the Summary Judgment, XRP rose to a high of $0.9327 in July 2023, but fears about a likely SEC appeal caused it to fall to a low of $0.4367 in August 2023.

The SEC must file its opening brief by December 2, 2024, but might request a 30-day extension.

XRPUSD Reaction to July 2023 Rulings

XRP Price Outlook: The Fed Rate Path and US Election Loom

Before the SEC’s opening brief, investors must consider the US Presidential Election on November 5 and the Federal Reserve’s interest rate announcement on November 7. If Trump wins, he may dismiss the SEC Chair before to the Fed’s November interest rate announcement.

If Trump wins and dismisses the SEC Chair, speculation that the SEC would abandon the appeal will likely increase. If the SEC withdraws its petition, XRP’s rise might parallel that of July 2023. In contrast, XRP may go below $0.50 if the SEC presents compelling grounds in its appeal of the Programmatic Sales judgment. The

Outlook

Investors should keep an eye on SEC appeal progress and US presidential election news, as both might have a substantial impact on XRP price patterns. Stay up to date with our latest news and analysis to better manage your exposure to XRP and the larger cryptocurrency market.

Price Action after XRP Faces Slump

XRPUSD 24/10/2024 Weekly Chart

Daily Chart

XRP is below the 50-day and 200-day EMAs, indicating bearish price indications.

A resumption to $0.5350 might pave the way for a move targeting the 200-day and 50-day moving averages. Furthermore, a break above the 50-day EMA might put the $0.5739 resistance level into play.

US Presidential Election news, Ripple case-related news, and SEC vs. crypto case-related developments must be considered.

A break below $0.50, on the other hand, might indicate a decline toward the trend lines.

With a 14-day RSI value of 39.76, XRP may go below $0.50 before reaching oversold territory.