After the FTX collapse, exchanges increased Bitcoin reserves transparency, with Binance and Bitfinex reporting substantial reserve growth.

November commemorates two years since the FTX exchange declared bankruptcy. Since then, prominent cryptocurrency exchanges have seen their Bitcoin holdings increase.

FTX’s failure to have enough reserves to accommodate customer requests revealed serious vulnerabilities in its controls. It also emphasized the importance of improved openness and trustworthy reserve reporting across all cryptocurrency exchanges.

Observers are more aware of the hazards that exchanges confront when they lack appropriate reserves. If they are unable to satisfy withdrawal requests, user confidence suffers, and they risk losing cash. Maintaining appropriate reserves is crucial for liquidity and order execution, particularly during tumultuous times.

CryptoQuant released a report with crypto.news on the current situation of exchange proof-of-reserves (PoR).

How has crypto changed post-FTX?

The fall of FTX in November 2022 marked a watershed moment in the crypto sector. This tragedy harmed investor trust and led significant changes to the crypto market’s structure and operation.

At the moment, Bitcoin’s price was -0.03%.Fear and distrust of institutional investors led to a decline in Bitcoin and other major cryptocurrencies. Many investors began to distrust cryptocurrency’s safety and stability, and as a result, some opted to exit the market entirely.

Attention to security concerns became much more critical. Many cryptocurrency exchanges and projects have begun to add new security measures to protect users’ assets, such as two-factor authentication, monitoring systems, and transaction analysis for suspicious activities.

New security requirements have evolved, as have measures to avoid fund loss in the event of a breach or fraudulent activity. The PoR standard requires cryptocurrency exchanges to publicly verify that they have enough assets in reserve to cover all customer balances.

“PoR fosters trust and transparency, as it allows users to confirm that an exchange has not over-leveraged or mismanaged their assets, which has become particularly crucial following high-profile exchange collapses in the industry.”CryptoQuant

Major exchanges record Bitcoin outflow

Coinbase is the only large exchange that does not disclose PoR data, despite having significant Bitcoin holdings. Experts point out that the other major exchanges issue similar reports on a regular basis, albeit with varied degrees of transparency.

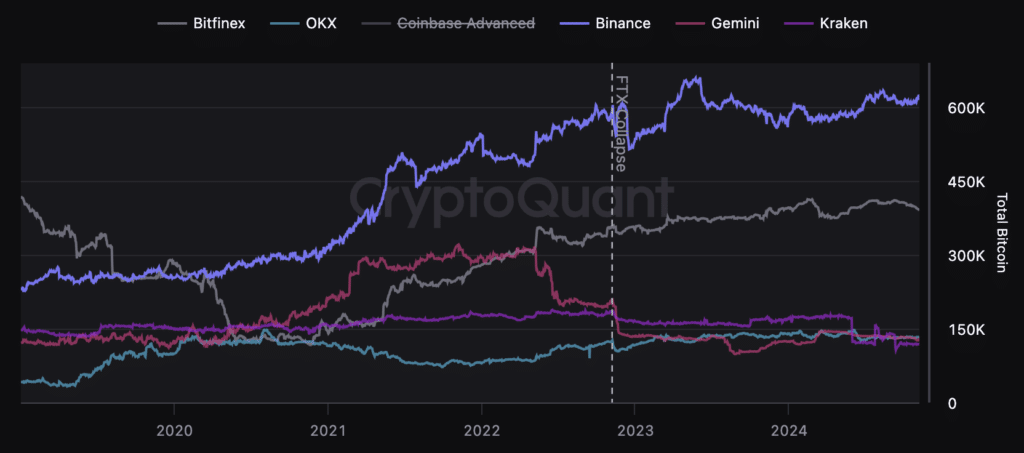

Binance’s reserves climbed by 28,000 BTC, or 5%, to 611,000 in 2023, despite pressure from US authorities. Among the main exchanges, Binance displays the most small reserve reduction during the time, not reaching 16%.

Three big exchanges control 75% of all Bitcoin owned by exchanges. These include Coinbase Advanced with 830,000 BTC, Binance with 615,000, and Bitfinex with 395,000 Bitcoins.

Together, these platforms’ reserves constitute 1.836 million BTC, or 9.3% of the total number of Bitcoins in circulation. The remaining 17 exchanges have a total of 684,000 Bitcoin.

Reserves landing

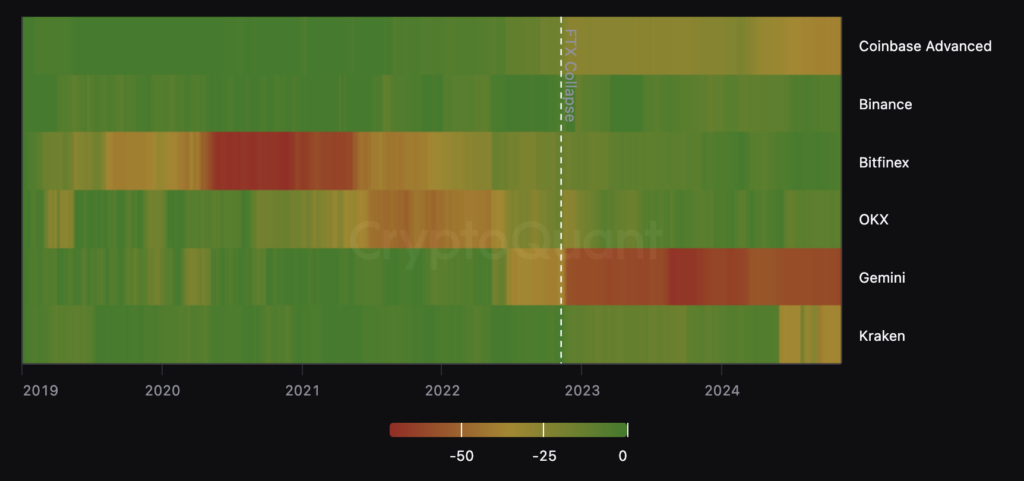

Binance, Bitfinex, and OKX are now seeing minor losses in reserves. At the same time, Binance looks to be the sole exchange without any severe drawdowns in its history.

Analyzing exchange reserves based on their variations helps us to estimate their long-term potential to satisfy user needs.

Significant decreases may suggest that consumers are withdrawing their monies in large quantities, indicating a loss of confidence or financial concerns.

Binance’s reserves dropped by 15% in December 2022, soon following the FTX crisis. Binance’s reserve report garnered much criticism and mistrust.

However, Binance’s reserves have rebounded and are now just down 7%. Other major exchanges have experienced small decreases, with Bitfinex down 5% and OKX down 11%.

While industry giants like Binance and Bitfinex have managed to shore up their reserves following the FTX crisis, the situation remains precarious. The inability of key businesses like as Coinbase to disclose PoR data indicates that true transparency remains a long way off. However, the present reserve patterns suggest a willingness to enhance and strengthen users’ trust.

In a message to crypto.news, the expert stressed that FTX’s bankruptcy highlighted the necessity for cryptocurrency exchanges to demonstrate that they have sufficient reserves.

“This occurrence resulted in a shift in user preference for exchanges that provide evidence of their assets on-chain. This prompted the industry to implement PoR policies, which helped reestablish confidence and ensured that exchanges could back up their users’ cash.Nick Pitto, Head of Marketing at CryptoQuant.

Read more: Bitbank Launche Crypto Investment Firm to Boost Blockchain surge

1 thought on “Bitcoin Reserves Shift at Major Exchanges Post-FTX Collapse”