Bitcoin ETFs experience record $870 million inflows, coinciding with a 66.5% rise in Trump’s election odds, fueling market interest.

- Bitcoin demand is increasing, mirroring 2016 election trends as Trump’s re-election chances improve.

- Record ETF inflows have boosted Bitcoin market confidence, indicating robust investor interest.

- Technical indicators show conflicting indications, with MACD indicating increasing momentum and RSI pointing to a likely downturn.

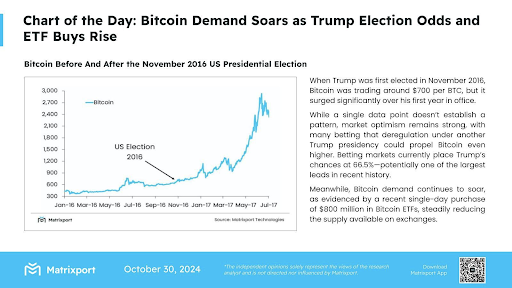

Bitcoin’s price and demand are rising, mirroring trends witnessed in the 2016 US presidential election cycle. However, betting markets set former President Donald Trump’s re-election odds at 66.5% for the next 2024 U.S. presidential elections, feeding Bitcoin euphoria and hopes of positive regulatory developments, resulting in an optimistic investor view.

As Bitcoin demand rises, recent inflows into Bitcoin exchange-traded funds (ETFs) add to the cryptocurrency’s momentum, perhaps setting up another price boom akin to 2016..

Historical Trends and Current Market Sentiment

When Trump won the 2016 presidential election, Bitcoin was selling at roughly $700 per BTC. Over the next year, Bitcoin’s value skyrocketed to about $3,000. Some observers link this increase to the prospect of pro-Bitcoin regulatory changes under Trump’s presidency.

With Trump’s prospective return appearing more plausible, market sentiment has improved as investors flock to Bitcoin as a hedge in a turbulent political environment. Betting markets show considerable support for Trump, indicating that regulatory changes might fuel greater Bitcoin gains.

Record Inflows in Bitcoin ETFs Indicate Growing Demand

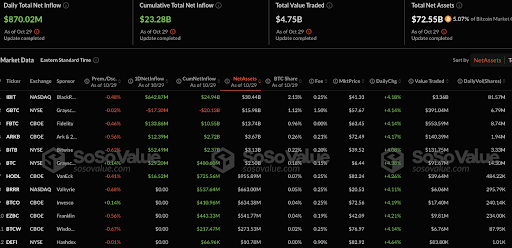

Aside from political concerns, U.S.-listed Spot Bitcoin ETFs saw more than $870 million in net inflows, the third-largest since the products’ launch in January.

BlackRock’s IBIT ETF topped with $629 million, followed by Fidelity’s FBTC ($133 million) and Bitwise’s BITB ($52 million). Grayscale’s BTC mini trust, VanEck’s HODL, and Ark’s ARKB were among the contributing ETFs.

Only Grayscale’s GBTC experienced a net outflow of $17 million. The total trade volume topped $4.75 billion, with IBIT accounting for $3.3 billion.

Bitcoin’s Market Movement

Bitcoin’s price reached $72,355.19, up 1.95%. The cryptocurrency market capitalization increased to $1.43 trillion during the last day, with trading volume increasing by 10.27% to $52.13 billion.

A technical examination of Bitcoin’s movement revealed a mixed prognosis. The MACD indicator is in a bullish alignment, with the MACD line above the signal line, indicating further upward momentum.

Read more: Binance OI Hits Record $8.3B: Impact on Market Volatility

1 thought on “Bitcoin ETFs See Record $870M Inflows as Trump’s Election Odds Rise”